Malevolent

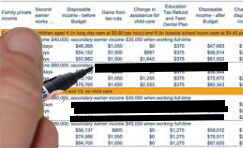

The 2014 budget omitted the table of adjusted family outcomes that

had been in every previous budget since 2005. The analysis was done by

treasury and available for inclusion but that it was not there indicates

it was deliberately omitted. The figures went to Cabinet, so they were

fully aware of the allegedly inequitable outcomes. Was it omitted for

political reasons? The Coalition and its budget already have a problem

with the public believing (and increasingly, and justifiably so) that it

is unfair. Long-term observers have held the suspicion that the

Coalition governs for its mates, the well-to-do, the elite, the

born-to-rule set, and nothing in the budget, nor the Coalition’s

rhetoric and off-budget policies since, have given cause to doubt this.

For just a few examples, consider:

- University FEE-HELP changes to impact disproportionately on poor graduates

- A permanent hit to pensions and welfare vs. a short-term levy for the rich

- The $7/visit co-payment for GP visits (the well-to-do might complain over a copayment but it is the poor who will simply stop going.) This might also reduce rates of vaccination in Australia, putting the whole country at greater risk.

The perception that the budget is unfair is widespread and even having an effect on business support

for the Coalition’s policies. Could the Coalition cope with further

documents showing that the poor would pay disproportionately for the

Coalition’s fictitious “budget repair process”, and that the Coalition

knew about it and went ahead anyway?

Fairfax and other outlets have sought this information,

and failed to receive it. Accordingly they and other analysts have done

their own sums on the basis of published figures. The analysis confirms

that the poor will be harder-hit than the wealthy.

Joe Hockey has been up in arms about Fairfax publishing this

analysis. “It doesn’t tell the whole story,” he says. “It doesn’t

reflect the fact that the rich pay more tax, and that the taxes of the

average wealthy person pay the social support for an average four

recipients of welfare.” Fairfax’s reporting “failed to take account of

the higher rate of income tax already paid by higher-income households”.

“Fairfax reporting has been malevolent,” he says.

Let’s pause for a moment and consider Hockey’s reported statements on the issue of equality, tax and welfare.

“In fact, just 2 per cent of taxpayers pay more than a

quarter of all income tax. Maybe these taxpayers would argue that the

tax system is already unfair.” “The average working Australian, be they a

cleaner, a plumber or a teacher, is working over one month full time

each year just to pay for the welfare of another Australian.”

http://www.abc.net.au/news/2014-06-11/hockey-tries-to-set-straight-perception-budget-is-unfair/5516718

What does this say about Joe Hockey’s fundamental concept of social

welfare? In a nutshell, it suggests that he is either beholden to, or at

least panders to, selfishness. In Hockey’s world, it is portrayed as a

bad thing that people with resources assist those without. This is a

profoundly anti-charitable approach.

Our society has put in place progressive tax systems, effective

social welfare structures and a range of subsidies, payments and tax

breaks in an ongoing and long-term attempt to find a comfortable middle

ground, where the privileged can continue to prosper whilst the

downtrodden are assisted to keep their heads above water. Obviously Mr

Hockey, and the Coalition, believe that the middle ground has trended

too far in one direction. The problem is that society as a whole does

not appear to agree with them.

Of course higher income households pay more tax. That’s the whole

point of a progressive tax system. To argue that it’s justified to

penalise low income workers more because they pay less tax is an attack

on the very principle of the sliding scale. That’s an ideological

position and it’s a valid choice, but it should be understood as

such. Penalising more or less on the basis of tax rates entails an

effective change in those rates. In other words, arguing that you can

implement changes that hurt the poor more than the rich because the

rich already pay more tax, is effectively arguing for a tax cut for the

rich, or an extra tax for the poor, depending on how you want to look

at it, and it is in no way an equitable outcome.

Let’s take a step backwards and approach this differently. Assume

that every Australian is going to pay the maximum $844/pa as a result of

the 2014 budget. Now you start handing some of that money back in

concessions. $50 to this group, $100 to that, $327 to the top bracket.

Why do you do this? Because they’re already paying a lot of tax. You are

levelling the playing ground. You are moving closer to a situation

where everyone pays the same amount of tax. This is the opposite of a progressive tax system.

Malevolent: adj. “Wishing evil or harm to another or others.” With

his 2014 budget, Mr Hockey is seeking to specifically do harm to those

who belong to a different socioeconomic class than himself. Now who’s

being malevolent?

Yes, Mr Hockey, the 2014 budget is indeed unfair. It does increase

inequity. You’ve known it since well before the budget was announced.

And the way you’re talking about it,

and responding to the questions about its unfairness, seems to indicate

that the unfairness is quite deliberate. I’m not entirely sure that’s

the message you were trying to achieve.

No comments:

Post a Comment